Core Entities of Alternative Investment Banking#

🧠 Introduction#

Alternative Investment Banking involves structured, private, and complex investments — like hedge funds, private equity, real estate funds, and private credit.

For someone entering this world, terms like GP, LP, custodian, valuation agent, and prime broker can be intimidating. But in reality, all these roles fall under eight core categories that form the backbone of any alternative investment transaction.

🧱 The 8 Core Entities and Their Extended Roles#

| Core Entity Type | Definition | Extended / Specialized Roles | Examples |

|---|---|---|---|

| 1. Investor | Provides capital and owns the investment | Limited Partner (LP), Fund of Funds (FoF), Family Office | Endowments, HNIs, Pension Funds |

| 2. Adviser / Manager | Makes investment decisions and manages the portfolio | General Partner (GP), Investment Advisor, Sub-Adviser, Portfolio Manager | Blackstone, PE Firms |

| 3. Security | The actual financial instrument being bought/sold | Private equity stake, hedge fund unit, real estate investment, loan instrument | CUSIPs, Bonds, Equity Shares, Real Estate Units |

| 4. Issuer | The party that issues or originates the security | Companies issuing bonds, equity, or debt | Microsoft, Google, Reliance, Startups, REITs |

| 5. Custodian/Broker | Holds the securities and processes transactions | Bank Custodian, Fund Administrator, Transfer Agent, Depository, Trustee | TD Wealth, State Street, Computershare, Morgan Stanley |

| 6. Auditor | Validates financial statements and calculations | Independent Auditor, Valuation Agent, NAV Verifier | PwC, KPMG, EisnerAmper |

| 7. Market | Enables price discovery, execution, and liquidity | Prime Broker, Exchange, OTC Market, Data Provider, Rating Agency | NYSE, Bloomberg, Moody’s, ICE |

| 8. Compliance / Legal | Ensures legal, tax, and regulatory alignment | Legal Counsel, Tax Advisor, Regulator (SEC, FCA), Fund Structuring Team, AML/KYC Compliance Provider, Fund Admin (for compliance NAV, PPM, filings) | SEC, EY Tax, Walkers Law, SEBI, FATCA Reporting |

What is a CUSIP? What are the Alternatives?#

CUSIP stands for Committee on Uniform Securities Identification Procedures. It is a 9-character alphanumeric code used in the United States to uniquely identify financial instruments (like stocks, bonds, mutual funds). CUSIPs are assigned by CUSIP Global Services (owned by S&P). A Citibank bond might have a CUSIP like 17325FBA5

Alternatives to CUSIP (Globally):

| Code System | Region / Use Case | Description |

|---|---|---|

| ISIN | International (Global Standard) | 12-character code used globally to identify securities (e.g., US17325FBA53) |

| SEDOL | United Kingdom | 7-character code used for identifying securities in the UK |

| RIC | Refinitiv Identifier (Thomson Reuters) | Symbol + exchange code (e.g., AAPL.OQ) |

| FIGI | Financial Instrument Global Identifier (by Bloomberg) | Open-source identifier alternative to CUSIP and ISIN |

| Ticker Symbol | Exchange-specific | Short alphabetic codes (e.g., AAPL, INFY, TSLA) used for listed stocks |

Market Entities#

The “Market” in the core entities refers to where securities are traded or priced, and can include both public exchanges and private markets.

- Private Deal Platforms for PE/VC

- Bond Markets (OTC or electronic)

- Crypto Exchanges (in some contexts)

Example of Public Market Entities

| Exchange | Region | Description |

|---|---|---|

| NYSE (New York Stock Exchange) | USA | Largest stock exchange by market cap |

| NASDAQ | USA | Tech-heavy electronic exchange |

| BSE (Bombay Stock Exchange) | India | One of the oldest stock exchanges in Asia |

| NSE (National Stock Exchange) | India | High-volume electronic trading in India |

| HKEX (Hong Kong Exchange) | Hong Kong | Gateway to Chinese capital markets |

| JPX (Tokyo Stock Exchange) | Japan | Asia’s largest stock exchange |

Security Identifcation in India#

India uses a combination of ISINs, symbol codes, and other identifiers for securities, depending on the context and system.

✅ 1. ISIN (International Securities Identification Number)#

Primary identifier used in India for all securities: equities, bonds, debentures, mutual funds, commercial papers, etc.

Follows the global ISO 6166 standard.

Format: 12 characters Example:

INE009A01021IN→ Country code for IndiaE009A→ Issuer code (assigned by NSDL)01021→ Security-specific ID

Who assigns it in India? ISINs are issued by NSDL (National Securities Depository Limited), designated by SEBI as the National Numbering Agency (NNA) for India.

✅ 2. Stock Symbols (Ticker Codes)#

- Short codes used on stock exchanges (NSE, BSE) for trading.

- Assigned by the exchange itself.

Stock Name NSE Symbol BSE Code Infosys INFY 500209 Reliance RELIANCE 500325 HDFC Bank HDFCBANK 500180

✅ 3. NSE/BSE Listing ID and Series Codes#

NSE and BSE also assign internal IDs, trading series codes, and listing identifiers for derivative contracts, debt instruments, etc.

Example:

- Equity segment:

EQ - SME segment:

SM - Debt segment:

N1,N2, etc.

- Equity segment:

🔁 Comparison Table: Global vs. India#

| Identifier Type | Used In | Assigned By | Used For |

|---|---|---|---|

| ISIN | Global / India | NSDL (India), other NNAs | Bonds, equities, mutual funds, debt |

| CUSIP | USA | CUSIP Global Services (S&P) | Bonds, equities, structured products (U.S.) |

| SEDOL | UK | London Stock Exchange | Stocks and bonds (UK focus) |

| Ticker Symbol | Global | Stock Exchanges (e.g., NSE) | Stock trading identification |

| FIGI | Global | Bloomberg | Open-source universal instrument ID |

In Summary,

- In India, the ISIN is the official identifier for securities — just like the CUSIP in the U.S.

- NSDL (on behalf of SEBI) is responsible for issuing ISINs.

- For exchange trading, NSE/BSE ticker codes are used for simplicity.

- SEBI regulates the whole identification ecosystem to ensure investor protection and transparency.

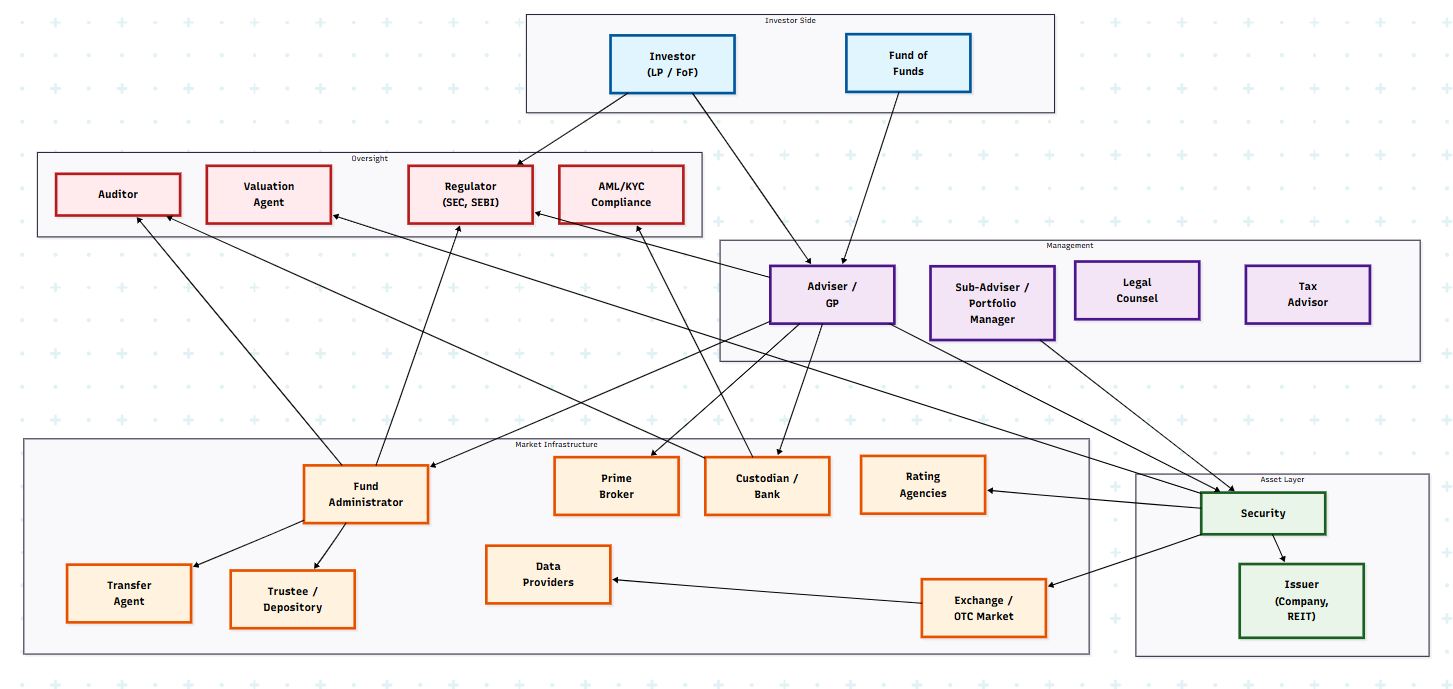

🗺️ How These Entities Interact#

🧩 Key Takeaways#

- The 8 core categories are still relevant and complete.

- Most additional entities you encounter (administrator, trustee, legal, tax, etc.) are just specialized roles under these categories.

- Understanding this structure simplifies everything from investment analysis to regulatory compliance and automated document processing.

📚 Conclusion#

Alternative Investment Banking is a multi-layered ecosystem, but it always boils down to 8 key types of roles. Every hedge fund, private equity deal, or real estate investment will involve some combination of:

👉 An investor funding the capital 👉 A manager making the investment decisions 👉 A security backed by an issuer 👉 A custodian holding the asset 👉 A market assigning value 👉 An auditor ensuring accuracy 👉 A compliance/legal team making sure it’s all above board

Once you grasp these building blocks, the world of alternative investments becomes far less intimidating — and much more exciting.

Comments: